kamerin.ru

Learn

Bonded Construction Company

A payment bond is a financial guarantee issued by a surety company on behalf of a contractor, ensuring that subcontractors and suppliers will be paid for their. Texas contractor bond costs start at $ annually. Your exact cost will vary depending on the city where you work, the license type you need, and the required. Performance bonds are types of surety bonds issued by a surety company that guarantee the satisfactory completion of construction projects by a contractor. In the context of the construction industry, a bond is a financial guarantee that protects project owners and ensures that contractors will fulfill their. The principal is the entity that purchases the bond, usually the general contractor or a subcontractor. The surety company is the company that provides the. Part of growing your business is expanding your bonding capacity, to help ensure you're able to get the surety bonds you need for the construction jobs you want. Bonding companies are, in effect, insurance companies that provide to owners and various claimants on a job site an alternative source of possible relief in. A Bond Facility is a commitment from a surety company to provide contract surety bonds for a qualified contractor to an agreed limit subject to the stated terms. FCA has developed a quick and easy bonding solution for contractors that are new to bonding across Canada. The program offers same day approvals for bonding. A payment bond is a financial guarantee issued by a surety company on behalf of a contractor, ensuring that subcontractors and suppliers will be paid for their. Texas contractor bond costs start at $ annually. Your exact cost will vary depending on the city where you work, the license type you need, and the required. Performance bonds are types of surety bonds issued by a surety company that guarantee the satisfactory completion of construction projects by a contractor. In the context of the construction industry, a bond is a financial guarantee that protects project owners and ensures that contractors will fulfill their. The principal is the entity that purchases the bond, usually the general contractor or a subcontractor. The surety company is the company that provides the. Part of growing your business is expanding your bonding capacity, to help ensure you're able to get the surety bonds you need for the construction jobs you want. Bonding companies are, in effect, insurance companies that provide to owners and various claimants on a job site an alternative source of possible relief in. A Bond Facility is a commitment from a surety company to provide contract surety bonds for a qualified contractor to an agreed limit subject to the stated terms. FCA has developed a quick and easy bonding solution for contractors that are new to bonding across Canada. The program offers same day approvals for bonding.

CMB Insurance Brokers is a surety insurance broker and we understand the unique risks and challenges faced by construction companies in Alberta. That's why we. Construction Bonding Company: A construction bonding company is an entity that specializes in providing surety bonds to contractors. These companies. The bond's purpose can vary based on the location, but generally, it guarantees that contractors perform construction work in compliance with all applicable. A surety bond is a risk transfer mechanism where the surety company assures the project owner (obligee) that the contractor (principal) will perform a contract. To qualify for a bond, a contractor must be in good financial standing. “Bond companies pre-qualify contractors by looking at their experience, financial. “Bonding” is the vetting process for contractors seeking a contract surety bond. Before we issue a contract surety bond, we evaluate the contractor's. Since opening our doors in , our family of companies has provided the Northeast with premier construction management and general contracting services and. The surety: The surety bond company that backs the surety bonds. · The principle: This typically refers to the general contractor in charge of the construction. A construction bond protects the project owner. The contractor has to meet certain criteria to qualify and pays a bond premium based on the job. Murray is the parent company of Construction Bonds, Inc. They have been helping contractors and contractor-related businesses with their insurance and bonding. A contractor bond Washington State ensures that these businesses offer high-quality services to customers and are held accountable for their services. When a contractor states they are bonded, it means they either have a surety bond, fidelity bond or both. The Agreement to Bond is a promise from the contractor's surety that if the contractor is awarded the contract, the surety company will issue the required. It is also referred to as a contract bond. A performance bond is usually provided by a bank or an insurance company to make sure a contractor completes. Construction bonds are also referred to as contractor bonds. Contractors are required to purchase them as a prerequisite for doing certain types of work and. It means there's an agreement between the contractor and the insurance company that is primarily meant to protect the contractor. You buy a policy once and hold. One of the most common sureties issued is a contractor surety bond. These are issued by licensed contractors, construction companies and businesses that hire. The principal is the entity that purchases the bond, usually the general contractor or a subcontractor. The surety company is the company that provides the. The bond costs between $ and $+ depending on the personal credit, license history, and classification of the contractor. Price Tier, Bond Cost*. Ultra-.

Cost Of A Private Airplane

Million to purchase, $ to $ annually (based on flying it – flight hours per year) depending on where you choose to base it. See the latest hourly rates of PrivateFly's most popular aircraft and how they compare including the Citation Mustang, King Air BE and Legacy Private jets are chartered by the hour ranging from $3, to $18, per hour and vary by the size, make, model, and age of the private jet. Sample round-trip. Flying hour onboard a mid-sized or super-mid-sized jet costs between $3, and $6, Choosing a large jet for your luxury flights will cost you approximately. How Much Does Private Jet Maintenance Cost. According to estimates on the cost of private jet maintenance, most jet owners end up shelling out between $, Let's start with the easy one. I found that business jet prices range from $3 million to $90 million, though one source says that about 85 percent of business. Ongoing Costs · A light jet can cost as much as $1, per flight hour, up to $, per year if you fly hours. · A midsize jet can cost $1, per hour. XO makes private jet flights accessible, efficient and transparent. Members and clients can request over aircraft worldwide and instantly book online. The average price of a private jet for sale on kamerin.ru is $8,, · In the past 30 days, the price has ranged from as low as. Million to purchase, $ to $ annually (based on flying it – flight hours per year) depending on where you choose to base it. See the latest hourly rates of PrivateFly's most popular aircraft and how they compare including the Citation Mustang, King Air BE and Legacy Private jets are chartered by the hour ranging from $3, to $18, per hour and vary by the size, make, model, and age of the private jet. Sample round-trip. Flying hour onboard a mid-sized or super-mid-sized jet costs between $3, and $6, Choosing a large jet for your luxury flights will cost you approximately. How Much Does Private Jet Maintenance Cost. According to estimates on the cost of private jet maintenance, most jet owners end up shelling out between $, Let's start with the easy one. I found that business jet prices range from $3 million to $90 million, though one source says that about 85 percent of business. Ongoing Costs · A light jet can cost as much as $1, per flight hour, up to $, per year if you fly hours. · A midsize jet can cost $1, per hour. XO makes private jet flights accessible, efficient and transparent. Members and clients can request over aircraft worldwide and instantly book online. The average price of a private jet for sale on kamerin.ru is $8,, · In the past 30 days, the price has ranged from as low as.

Discover the true cost of a private jet and the benefits of fractional jet ownership with NetJets. Learn about the myths of private jet ownership. A tool to quickly and easily calculate the cost of a private jet charter. The charter flight cost calculator allows you to conduct a preliminary aircraft. Flight prices depend on many variables, such as - flight route, aircraft model (configuration, year of manufacture), number of crew, passengers, days of. A tool to quickly and easily calculate the cost of a private jet charter. The charter flight cost calculator allows you to conduct a preliminary aircraft. Ultralight Aircrafts: Single-seat, single-engine recreational planes. These may be purchased for an up-front cost of $8, to $15, Single-Engine Planes. When chartering a private jet or plane, the cost per hour can be anywhere from $1, to over $13,, depending on the size and type of plane, fuel surcharges. When chartering a private jet or plane, the cost per hour can be anywhere from $1, to over $13,, depending on the size and type of plane, fuel surcharges. Cost to Charter a Private Jet in Canada. The cost to charter a private flight to/from Canada starts at around $2, an hour* for a turboprop, $5, an hour*. Summary · Renting private jets can cost between $1, - $14, per hour, based on aircraft size. · Buying a private jet can range from $1M to $78M; additional. How much does a private jet charter cost? The average cost to charter a private jet ranges from about $1, to $14, per flying hour. The price varies based. A decent Citation X right now is going for anywhere between $8mil-$12mil and it costs right around $1mil/year to operate (fuel, maintenance. Prices range between $3,, and $8,, with 55 currently advertised for sale. View Gulfstream G private jets for sale. Sample Operating Budget. Cost. Private Jet Rental costs: Light Jets, $ – $ ; Midsize Jets, $ – $ ; Large Jets, $ – $ ; VIP Airliners, $+. The cost to charter a private flight in starts at around $2, an hour* in a turboprop, $5, an hour* in a light jet, $7, an hour* in a midsize jet. AEROAFFAIRES offers you the best rates for customised rental of your private jet, with no extra costs. Use the Jettly private jet charter cost estimator tool and get instant private jet charter prices between any two geographic locations worldwide. See the latest hourly rates of PrivateFly's most popular aircraft and how they compare including the Citation Mustang, King Air BE and Legacy Understanding Private Jet Charter Pricing ; Light Jet, $2, - $3,, $ ; Midsize Jet, $3, - $4,, $ ; SuperMidsize Jet, $4, -. In general, whole ownership and the associated fees and maintenance can run you anywhere from $, to $4 million per year. Here are a few factors. Light jets can finish your flight to the Hamptons in just under half an hour, with a price of around $4, for a one-way. Other popular light jets in the NY.

Are Sba Grants Taxable

If you received a grant for this program in , you are required to report it on your upcoming tax returns. In order to do so, you will need to retrieve. You do not have to pay the grant back but it will be taxable. Only businesses which make an overall profit once grant income is included will be subject to tax. Before filing end-of-year taxes or applying for an SBA loan or SBA grant, it's important to consult with an accountant or tax attorney to determine if the loan. kamerin.ru The program does not offer legal or tax advice to grant recipients. Assists small and medium-sized businesses with affordable loans. New Market Tax Credits Below-market rate loans or equity investments that can save eligible. The RRF offers an eligible food and beverage business with a tax-free, federal grant that matches the eligible business's revenue loss(es) resulting from the. Verification for Tax Information: IRS Form T, completed and signed by applicant. Completion of this form digitally on the SBA platform will satisfy this. This means that for both tax years, forgiven loans are not taxable in deductible business expenses paid using forgiven PPP loans are also deductible. The free aspect is that the money does not have to be repaid. In most cases grant money received is in fact taxable business income. There are limited. If you received a grant for this program in , you are required to report it on your upcoming tax returns. In order to do so, you will need to retrieve. You do not have to pay the grant back but it will be taxable. Only businesses which make an overall profit once grant income is included will be subject to tax. Before filing end-of-year taxes or applying for an SBA loan or SBA grant, it's important to consult with an accountant or tax attorney to determine if the loan. kamerin.ru The program does not offer legal or tax advice to grant recipients. Assists small and medium-sized businesses with affordable loans. New Market Tax Credits Below-market rate loans or equity investments that can save eligible. The RRF offers an eligible food and beverage business with a tax-free, federal grant that matches the eligible business's revenue loss(es) resulting from the. Verification for Tax Information: IRS Form T, completed and signed by applicant. Completion of this form digitally on the SBA platform will satisfy this. This means that for both tax years, forgiven loans are not taxable in deductible business expenses paid using forgiven PPP loans are also deductible. The free aspect is that the money does not have to be repaid. In most cases grant money received is in fact taxable business income. There are limited.

Government grants are funded by your tax dollars and, therefore, require SBA Federal Grant Resources · Small Business Innovation Research (SBIR). If a business does not provide documentation for all eligible expenses or the business made purchases that were not eligible under the grant guidelines, the. Verification for Tax Information: IRS Form T, completed and signed by applicant. Completion of this form digitally on the SBA platform will satisfy this. If you received a grant for this program in , you are required to report it on your upcoming tax returns. In order to do so, you will need to retrieve. Generally yes. Payments made under the three WTC grant programs (BRGP, SFARG, and JCRP) are included within the broad definition of "gross income" under § SBA Disaster Loan Program - SBA is providing low-interest disaster loans for Tax Assistance. Employee Retention Tax Credit - The IRS introduced an. The Shuttered Venue Operator Grant (SVOG) program of the SBA provides grants to support shuttered live venues, theaters, museums, and zoos that have experienced. Federal: The payments are not taxable, nor will they reduce a taxpayer's Small Business Administration (SBA) Grants: Federal: Economic Injury. If a business does not provide documentation for all eligible expenses or the business made purchases that were not eligible under the grant guidelines, the. kamerin.ru The program does not offer legal or tax advice to grant recipients. SBA Shuttered Venue Operators Grant of $, or less. Ineligible Businesses: All Non-Profits, Churches and other religious institutions; and; Government-. Business tax returns (IRS Form or IRS S); IRS Forms Schedule C State and local grants (via CARES Act or otherwise); SBA Section Forgiven PPP loans are not taxable for personal income taxpayers, including unincorporated businesses reporting income and expenses on Schedule C, partners in a. forgivable loans and emergency grants for small businesses, including the: · tax incentives; · paid leave; · state disaster assistance; · unemployment insurance;. upon receiving invoices from the agencies administering the programs. Q: Are my grants and loans taxable or subject to tax offset? A: RELIEF Act grant and loan. On your federal income tax return, the Restore Louisiana recovery grant is taxable because you had previously deducted the disaster casualty loss. Since. Loans, Grants, & Tax Credits. Page Sections. ARPA Small Business Grants CDBG Small Business Microgrant Program Loan-to-Grant Program Revolving Loan Fund Local. SBA table of Size STANDARDS small business improvement grant securing your tax clearance small business improvement grant green building requirements. Review program data. SBA maintains access to data for all its current and past COVID relief programs, including grant recipient information as required by. The Shuttered Venue Operator Grant (SVOG) program of the SBA provides grants to support shuttered live venues, theaters, museums, and zoos that have experienced.

Negotiating On Used Car At Dealership

Research Car Prices. Can you negotiate used car prices at a dealership? Absolutely, many car dealerships allow the ability to negotiate used car prices. Three tips for shopping for your next new car. While Used vehicles at all Herb Chambers Dealerships are individaully smart priced so there is no need for. Another tip for negotiating the price of a used car is to pay a mechanic to do a professional inspection. If the mechanic finds any issues, you can factor their. 1. Do your research · 2. Determine your budget · 3. Get pre-approved for financing · 4. Know the dealer's bottom line · 5. Be strategic in making the right opening. Now, about that rule of thumb for negotiating – there's no hard and fast rule like "always ask for % off." It's more about the specific car. Getting to a starting point in terms of a suggested price for a vehicle can make or break the negotiation process almost immediately after it has begun. To do. One of the rules of friendly negotiation says once you as a buyer mention a price, you can't go any lower. Once they, as a seller, mention a price, they can't. Then go back to the other dealers and ask if they can beat it. Once you have the best price, you're ready to buy. Don't volunteer information. In negotiating. A good rule of thumb when deciding how much to negotiate on a used car is to aim for paying the market value of the vehicle, since that's likely a fair price. Research Car Prices. Can you negotiate used car prices at a dealership? Absolutely, many car dealerships allow the ability to negotiate used car prices. Three tips for shopping for your next new car. While Used vehicles at all Herb Chambers Dealerships are individaully smart priced so there is no need for. Another tip for negotiating the price of a used car is to pay a mechanic to do a professional inspection. If the mechanic finds any issues, you can factor their. 1. Do your research · 2. Determine your budget · 3. Get pre-approved for financing · 4. Know the dealer's bottom line · 5. Be strategic in making the right opening. Now, about that rule of thumb for negotiating – there's no hard and fast rule like "always ask for % off." It's more about the specific car. Getting to a starting point in terms of a suggested price for a vehicle can make or break the negotiation process almost immediately after it has begun. To do. One of the rules of friendly negotiation says once you as a buyer mention a price, you can't go any lower. Once they, as a seller, mention a price, they can't. Then go back to the other dealers and ask if they can beat it. Once you have the best price, you're ready to buy. Don't volunteer information. In negotiating. A good rule of thumb when deciding how much to negotiate on a used car is to aim for paying the market value of the vehicle, since that's likely a fair price.

The best times to negotiate the price of a Pre-Owned car are at the end of the day, on the weekends, and on the last few days of the month. Another good time to. Haggling: Don't hesitate to negotiate with multiple dealers and use their prices as leverage. After visiting a few dealerships, feel free to revisit the. Arriving at a dealership or meeting with a private-party seller unprepared is one of the main reasons people overpay for both new and used cars. If you want to. Go to the dealer with cash. Especially if you're negotiating for a used car, dealers are much more likely to go down in price if you have cash. [9]. A savings of 5% or so below the market value (not the price they are asking) is a reasonable starting point for negotiations. Another way to look at it is to do. A savings of 5% or so below the market value (not the price they are asking) is a reasonable starting point for negotiations. Another way to look at it is to do. That's why we created this must-have resource for buying a new or used car at a dealership, whether in person or through the internet sales department. This car. Do your research beforehand · Have a fixed budget in mind · Use the vehicle's condition to your advantage · Warranties · Don't fall into the trap of dealers '. Do Your Research. Before stepping onto any dealership lot, it's crucial to be well-informed about the used cars for sale you are interested in. · Inspect the. When your sales associate tells you the full price of the vehicle, you can tell them that the price is higher than what you've seen in your research. Then show. Do your research · Pre-approve financing · Start low · Be firm · Be prepared to walk away · Be Strategic · Take Your Time · Get the Vehicle History Report. When negotiating with a dealer, focus on the out-the-door price instead of any other payment metric. This will keep you focused on the car's purchase price. How to Negotiate for a Used Car · Research the Car's Attributes and Pricing · Negotiating a Price (If You Choose) · Take Advantage of Pre-Owned Vehicle Specials. The best way to get a great deal on a new or used car is to walk away from a bad one. It is your greatest negotiation tool, though too few consumers have the. The sticker price on used cars usually isn't the cheapest price the seller will accept. Whether you're buying from a dealership or a private seller. The short answer: yes but it depends. You have to know how to negotiate used car prices, know what to research and understand exactly how much the listed price. Stay organized. Keep your research handy and write down the price you're offering the dealership. If you feel like the negotiations are going nowhere fast, you. Dealership transactions are much simpler than dealing with a private buyer. Car dealerships have criteria in place for accepting used cars. The first thing they. Before we go over how to negotiate a used car price with a dealer, you'll want to keep in mind that not every dealer in the Westfield area will negotiate on. You need vital information about the market value, demand, and price of your desired car to lay the foundation of your negotiation. You can use pricing guides.

Why Do You Have To Pay For Turbotax

Cost: $0* to $ for federal taxes. (State taxes are an additional $69 each with paid products.) Who this is for: For those who have simple taxes and plan to. A lock icon or https:// means you've safely connected to the official website. Sales and Use Tax File and Pay - E · Electronic Filing Options and. TurboTax's Free Canadian software costs $0 and is ideal for various tax situations. Start filing your secure tax return for free. Milwaukee, WI Note: If you do not have your voucher, visit our Payment Vouchers page to create one. If you file your income tax return on paper. We accept all major credit and debit cards, but you can also choose to pay for your TurboTax fees right out of your federal tax refund. There's an additional. E-file your federal and state taxes online with TaxAct. Explore tax products for a wide range of tax filing situations and get your maximum tax refund. Got a simple tax situation? File your tax return for $0. If you have more complex taxes, pay just $ See promotion details below. But even though they're easy to use, Turbotax and others are still software programs that have limitations just like any other robot. When your financial. Simple tax returns are free. Have a simple tax situation? TurboTax Online has you covered. File your simple tax return for $0. Cost: $0* to $ for federal taxes. (State taxes are an additional $69 each with paid products.) Who this is for: For those who have simple taxes and plan to. A lock icon or https:// means you've safely connected to the official website. Sales and Use Tax File and Pay - E · Electronic Filing Options and. TurboTax's Free Canadian software costs $0 and is ideal for various tax situations. Start filing your secure tax return for free. Milwaukee, WI Note: If you do not have your voucher, visit our Payment Vouchers page to create one. If you file your income tax return on paper. We accept all major credit and debit cards, but you can also choose to pay for your TurboTax fees right out of your federal tax refund. There's an additional. E-file your federal and state taxes online with TaxAct. Explore tax products for a wide range of tax filing situations and get your maximum tax refund. Got a simple tax situation? File your tax return for $0. If you have more complex taxes, pay just $ See promotion details below. But even though they're easy to use, Turbotax and others are still software programs that have limitations just like any other robot. When your financial. Simple tax returns are free. Have a simple tax situation? TurboTax Online has you covered. File your simple tax return for $0.

If your personal tax situation is more complex, and you do need to upgrade, we'll clearly explain the reason. H&R Block Free Online vs TurboTax Free Edition. The payment date will be the date the charge is authorized. Need an extension? If you pay part ($1 minimum) or all of the tax you estimate you will owe using a. You have the deluxe version which means you must either have some credits which require that version or you accidentally upgraded (not likely). Review your fees to find out why you're being charged. Then, follow the directions to remove any unwanted charge. TurboTax Free customers are entitled to a payment of $ Claims must be submitted within sixty (60) days of your TurboTax filing date, no later than May Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or. Benefits of Electronic Filing · Convenience – You can electronically file 24 hours a day, 7 days a week. · Security – Your tax return information is encrypted and. Whether our experts prepare your tax return or you do it yourself, we guarantee our calculations are always % accurate, or we'll pay any penalties* (1). Use this filing status if you were single on December 31, in the tax year. You are single if any of the following apply to you: You have never been married. You. Those who want to prepare their own taxes can use TurboTax with prices starting at $ Taxpayers who want expert assistance will have a starting payment of $ Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or. We do your taxes for you. Have a dedicated tax expert handle everything, from start to finish. Consumers who have more complex tax situations, like income from self-employment or earnings from investments, will need to pay to use a tax filing program that. If you've already received a bill or notice of assessment for this payment, go to bill payment options. Estimated Tax; Balance Due on Return; Extension Payment. Should You Get It? So long as you're not planning on claiming anything other than the standard deduction, the earned income tax credit, or the child tax credit. File an extension: No matter your income, you can file an extension with a trusted IRS Free File partner. You must estimate and pay the tax you owe and file by. tax bills. Collections. If you have a bill that is being handled by the Division of Collections and you would like to pay in full or set up a payment. You may be able to get a tax refund if you've paid too much tax or you're How do I know if you have my current address? How do I change my address. Click the Filing Your Taxes simulation to begin. Once you have completed the first simulation, select one or more of the remaining simulations to explore how. If you have an existing tax liability, you may be able to pay online. You If you are self-employed or do not have Maryland income taxes withheld by.

Credit Card Buyer Protection

Chase credit card purchase protection covers you for up to $50, annually for lost, damaged, or stolen items. Claims must be filed within days of the. Purchase Protection can reimburse you for the full payment plus original shipping costs. See terms and limitations. The Purchase Protection coverage provides reimbursement for the theft and/or accidental damage of purchase items, up to forty five (45) days from the date. Purchase protection is generally “secondary coverage,” which only kicks in if other options don't work. So, for instance, if you can still return the item, your. The Purchase Protection coverage provides reimbursement for the theft and/or accidental damage of purchase items, up to forty five (45) days from the date. Purchase protection: If you buy something with your card and it gets lost, stolen, or damaged not long after, purchase protection allows you to get that. When you pay in full for an item with your eligible Visa you will receive, free of charge and without registering, protection against theft or accidental. Can repair, replace or reimburse you for eligible items in the event of theft or damage when items are purchased with an eligible Chase card. Can repair, replace or reimburse you for eligible items in the event of theft or damage when items are purchased with an eligible Chase card. Chase credit card purchase protection covers you for up to $50, annually for lost, damaged, or stolen items. Claims must be filed within days of the. Purchase Protection can reimburse you for the full payment plus original shipping costs. See terms and limitations. The Purchase Protection coverage provides reimbursement for the theft and/or accidental damage of purchase items, up to forty five (45) days from the date. Purchase protection is generally “secondary coverage,” which only kicks in if other options don't work. So, for instance, if you can still return the item, your. The Purchase Protection coverage provides reimbursement for the theft and/or accidental damage of purchase items, up to forty five (45) days from the date. Purchase protection: If you buy something with your card and it gets lost, stolen, or damaged not long after, purchase protection allows you to get that. When you pay in full for an item with your eligible Visa you will receive, free of charge and without registering, protection against theft or accidental. Can repair, replace or reimburse you for eligible items in the event of theft or damage when items are purchased with an eligible Chase card. Can repair, replace or reimburse you for eligible items in the event of theft or damage when items are purchased with an eligible Chase card.

Protect yourself from damages or theft with Visa Purchase Protection on our debit and credit cards. The Amazon Prime card has pretty good purchase protection. If you want anything more than that, you'll likely to pay an AF. Visa Business card and the eligible item meets the terms and conditions of coverage. •Extended Protection. Yes, as long as you purchased the item entirely with. Chase Purchase Protection is coverage that protects cardmembers against loss, theft or damage of eligible items purchased with a Chase credit card. Find American Express Credit Card Terms for Purchase Protection for Eligible Credit Cards. Learn More About this Benefit & Purchase Protection Policies. The scheme enables you to claim a refund from your card provider if a purchase doesn't arrive or is faulty. Here's how to get your money back via chargeback. Cover if your purchases are lost, stolen or damaged. Access to up to 4 months Purchase Protection Insurance on eligible purchases. Cardholder of $60, for claims under Purchase Security and Extended. Protection in respect of all CIBC Visa™ Cards held by a Cardholder. The. Cardholder is. ICICI Amazon Pay Credit Card: 5% cashback at Amazon for Prime member and 3% for others. · Flipkart Axis Bank Credit Card: 5% cashback at Flipkart. Return protection is another form of purchase protection offered by some credit cards. It allows you to return an item for a set period of time defined in your. By ensuring Visa cardholders know they have the right to initiate action to get their money back for purchases made online, by phone or by mail that have been. This insurance will protect you in the event that a newly purchased item is lost, stolen, or damaged, which is bound to save you money. Here's a brief rundown. Optional BalanceProtector® insurance can be added to your RBC Royal Bank credit card. BalanceProtector® Max is a low-cost way to make sure your RBC Royal Bank®. The Amazon Prime card has pretty good purchase protection. If you want anything more than that, you'll likely to pay an AF. Erika Taught Me · Purchase protection can cover the cost of damaged or stolen items purchased within the last 90 to days. · You may need to file a claim. If something you bought with your card is damaged or stolen within days of purchase, you are protected. Terms and Conditions. Coverage is limited to the. Purchase Protection guards against the theft of eligible items of personal property purchased with your Members 1st credit card within the first ninety (90). if was damaged then you would need to fix it pay it with your card and they would reimburse you. It was stolen then you need a police report as. It provides coverage for items against loss, theft, or accidental damage, usually for up to six months from the time of purchase. Purchase protection will reimburse you for theft, loss or accidental damage to eligible items that occurred within 90 days of purchase.

Car Loan Calculator With Deposit

Use our auto loan interest calculator to see what your monthly payment might look like—and how much interest you would pay over the life of the loan. Calculate my car payment. The segment landing page is Personal Insights. Click here to go to segment landing page. Your monthly car payment is based on the. Use this helpful car payment calculator to determine what your monthly auto loan payment will be, and let us help you secure a loan with great rates for. Estimate your monthly car payment with our payment calculators. Ready to take the next step? Get pre-qualified with no impact to your credit score. They are usually offered at banks and credit unions backed by a car, personal savings, or certificates of deposits as collateral. Like all other secured loans. Use Carvana's auto loan calculator to estimate your monthly payments. See how interest rate, down payment & loan term will impact your monthly payments. Estimate your monthly payments with kamerin.ru's car loan calculator and see how factors like loan term, down payment and interest rate affect payments. Average interest rate for a car loan. In Q1 , the average interest rate for a new car was % and % for a used car, according to Experian. When it. Use our free auto loan calculator to determine your monthly payment on a car, truck, or other vehicle loan, so you know how much you can afford. Use our auto loan interest calculator to see what your monthly payment might look like—and how much interest you would pay over the life of the loan. Calculate my car payment. The segment landing page is Personal Insights. Click here to go to segment landing page. Your monthly car payment is based on the. Use this helpful car payment calculator to determine what your monthly auto loan payment will be, and let us help you secure a loan with great rates for. Estimate your monthly car payment with our payment calculators. Ready to take the next step? Get pre-qualified with no impact to your credit score. They are usually offered at banks and credit unions backed by a car, personal savings, or certificates of deposits as collateral. Like all other secured loans. Use Carvana's auto loan calculator to estimate your monthly payments. See how interest rate, down payment & loan term will impact your monthly payments. Estimate your monthly payments with kamerin.ru's car loan calculator and see how factors like loan term, down payment and interest rate affect payments. Average interest rate for a car loan. In Q1 , the average interest rate for a new car was % and % for a used car, according to Experian. When it. Use our free auto loan calculator to determine your monthly payment on a car, truck, or other vehicle loan, so you know how much you can afford.

Estimate your car payment using our free auto loan calculator and compare auto loan rates for new & used vehicles. Auto finance and refinancing available. The size of your monthly payment depends on loan amount, loan term and interest rate. Loan amount equals vehicle purchase price minus the down payment, net. Estimate your monthly car loan payment and try different scenarios with our handy calculator. Use this calculator to determine how much your monthly payment will be with a car loan. Deposit and loan products offered by: Louisiana Federal Credit Union. Our auto loan calculator will provide detailed cost estimates for any proposed car loan. Find the monthly payment, total cost, total interest and more! Before applying for your auto loan with TDECU, review your overall financial situation. This will help determine the monthly payment and total car cost you can. Auto Loan Calculator. Get a better idea of what your payments would be for a new or used car, truck, or SUV. Input the variables below and see what it would. Use Ally's car payment calculator to estimate your monthly payments. See how down payment, APR and term length affect payment amount. Use the First Financial Auto Loan Calculator below to find out exactly how much car you can afford. Not a Deposit; Not FDIC Insured; Not Insured by Any. Auto loan interest rates are the Annual Percentage Rate (APR) you'll pay on what you withdraw from a HELOC, spread out over monthly payments. These rates vary. Use our car payment calculator to determine what your monthly car payments will be. Free and easy-to-use automated calculator which quickly estimates your monthly car loan payments & helps you figure out how expensive of a car you can. Find out what your monthly car loan payment will be before you apply for your loan. Use the Auto Loan Calculator from Credit Union ONE get an estimate. Find the right car payment. Know exactly how much your new car will cost each month. Use this auto loan calculator to determine your monthly payment for the. Determine your monthly auto loan payment or your auto purchase price using our calculator. Learn how different interest rates impact your payments. (Psst, click the little blue plus sign next to any of the input labels on the calculators for more details.) Calculator Disclaimer. Calculate a Vehicle Payment. Estimate Your Car Payment - Determine your car payment with our easy-to-use auto loan payment calculator. Take a look and apply online today. Many factors determine the total loan amount for the purchase of a new or used vehicle. Use our auto loan calculator to estimate your monthly payment. You can choose to calculate the payment or the purchase price. Monthly payment. The amount you pay each month for your auto financing. Total purchase price. Use the SchoolsFirst FCU calculators to estimate your budget, savings, loan, and mortgage needs and more.

Best Place To Get A Money Order

And you have to go to a bank during banking hours to obtain them, offering fewer time and location options. So if a money order can handle the job, it can be a. Finally, we've been serving independent retailers for over 30 years with several customers who have been with us for decades. Money Orders are a great way to. You can buy money orders at any Post Office to send anywhere. You can cash money orders at the Post Office. USPS replaces lost, stolen, and damaged money. find out what they need. How Long are Money Orders Good For? Money orders don't expire, but locations that cash money orders may have their own policies. Top 10 Best Money Orders Near New York, New York ; 1. PLS checking Cashing · (7 reviews) · mi ; 2. US Post Office · ( reviews) · mi ; 3. CFSC Checks Cashed. Here you will find the best local places to get a money order now. Use our handy zipcode search tool to locate the closest money order place to you. Money orders offer a reliable, convenient alternative to cash or a check. Buy and cash money orders at a Western Union location near you. Western Union agent location. To find an agent location near you, follow these steps: Go to our website or app. Select Find Locations at the top of the screen. Money orders offer a low cost option for making payments. MoneyGram money orders offer the convenience of a check without the need for a checking account. And you have to go to a bank during banking hours to obtain them, offering fewer time and location options. So if a money order can handle the job, it can be a. Finally, we've been serving independent retailers for over 30 years with several customers who have been with us for decades. Money Orders are a great way to. You can buy money orders at any Post Office to send anywhere. You can cash money orders at the Post Office. USPS replaces lost, stolen, and damaged money. find out what they need. How Long are Money Orders Good For? Money orders don't expire, but locations that cash money orders may have their own policies. Top 10 Best Money Orders Near New York, New York ; 1. PLS checking Cashing · (7 reviews) · mi ; 2. US Post Office · ( reviews) · mi ; 3. CFSC Checks Cashed. Here you will find the best local places to get a money order now. Use our handy zipcode search tool to locate the closest money order place to you. Money orders offer a reliable, convenient alternative to cash or a check. Buy and cash money orders at a Western Union location near you. Western Union agent location. To find an agent location near you, follow these steps: Go to our website or app. Select Find Locations at the top of the screen. Money orders offer a low cost option for making payments. MoneyGram money orders offer the convenience of a check without the need for a checking account.

This Week's Best Deals Boost Membership Free Digital With more than 2, locations available, a Money Services Desk is always conveniently accessible. If you want to cash your money order for free, the best place, arguably, is at your local bank or credit union. Since banks have large amounts of money on the. To purchase a money order, you can go to any United States Post Office location and many drug stores in NYC. The cost of a money order is usually under $2, plus. Our money orders are perfect for paying bills or sending money to area, so you will likely find one nearby. Get your money order from WSCE today! How do I get a money order from Walmart? Buy money orders from any Walmart store location & visit the Customer Service Desk or Money Services Center. Where to get a money order: 7 places to grab one · 1. The post office · 2. Convenience stores · 3. Check-cashing stores · 4. Western Union · 5. MoneyGram locations. Best Deal Anywhere. Amscot Money Orders are FREE! Why pay a fee to You never have to pay a fee to purchase a money order at Amscot. As many as. Top 10 Best Money Orders Near Los Angeles, California · 1. US Post Office. ( reviews) · 2. Western Union. (5 reviews) · 3. Los Angeles Check Cashing -. Some places may limit them to smaller amounts. If you need to purchase multiple money orders to get around the limit, you may be better off getting one. Here are a few ways to spot a fraudulent postal money order: • Look closely at the paper. Valid postal money orders have special markings and designs to prevent. Western Union is also a good place and is found in many grocery stores. They don't have a set fee, but you may pay up to a $1 for money orders. The memo field is also a good place to put account or order numbers that the You'll get a receipt for the money order that has a tracking number. Depositing money orders is a good option for recipients concerned about the fees charged to cash the certificates at other locations. Can be issued in one. Money orders are a great way to make purchases and pay bills regardless of whether you have a checking account or not. Usually, it's best to cash a money order at the location where the sender purchased it. Even better, if you already have an account with a bank or. Depositing money orders is a good option for recipients concerned about the fees charged to cash the certificates at other locations. Can be issued in one. Because you pay for a money order with cash, it can be a good alternative payment method if you don't have a bank account or access to paper checks. Another. top left corner. If there is no address printed, you should use a To purchase a money order, you can go to any United States Post Office location. GET money orders, SEND money transfers and PAY bills at this MoneyGram® location inside SUPER A FOODS - #7 on DIVISION ST in Los Angeles, CA. Some stores may charge fees, but this is another good option if you don't have a bank account. U.S. Postal Service: The post office is a great place to cash any.

What Is Cboe Exchange

@CBOE. The Exchange for the World Stage. Connecting people to financial markets since Financial Services Chicago kamerin.ru Joined October. Chicago-based Cboe is the third-largest U.S. stock-exchange operator after the NYSE and Nasdaq Inc., as measured by market share. As a division of the parent. Cboe Global Markets, Inc. is an American company that owns the Chicago Board Options Exchange and the stock exchange operator BATS Global Markets. Cboe Global Markets Inc. ; Day Range - ; 52 Wk Range - ; Volume, K ; Market Value, $B ; EPS (TTM), $ The Cboe Digital Exchange Rulebook describes the CFTC-regulated designated contract market (DCM) organization, the obligations and responsibilities of. Cboe Australia Pty Limited ('Cboe Australia') is an alternative trade execution venue to the ASX which uses its own trading system and provides trading in. Chicago Board Options Exchange (CBOE). A securities exchange created in the early s for the public trading of standardized option contracts. Cboe is an alternative trading exchange to the ASX. Both exchanges allow you to buy or sell the same Australian-listed stocks. In the case of purchasing a stock. Cboe is the largest cash Equity/Index options market in the United States. Launched in as an options trading venue, asset classes traded and published. @CBOE. The Exchange for the World Stage. Connecting people to financial markets since Financial Services Chicago kamerin.ru Joined October. Chicago-based Cboe is the third-largest U.S. stock-exchange operator after the NYSE and Nasdaq Inc., as measured by market share. As a division of the parent. Cboe Global Markets, Inc. is an American company that owns the Chicago Board Options Exchange and the stock exchange operator BATS Global Markets. Cboe Global Markets Inc. ; Day Range - ; 52 Wk Range - ; Volume, K ; Market Value, $B ; EPS (TTM), $ The Cboe Digital Exchange Rulebook describes the CFTC-regulated designated contract market (DCM) organization, the obligations and responsibilities of. Cboe Australia Pty Limited ('Cboe Australia') is an alternative trade execution venue to the ASX which uses its own trading system and provides trading in. Chicago Board Options Exchange (CBOE). A securities exchange created in the early s for the public trading of standardized option contracts. Cboe is an alternative trading exchange to the ASX. Both exchanges allow you to buy or sell the same Australian-listed stocks. In the case of purchasing a stock. Cboe is the largest cash Equity/Index options market in the United States. Launched in as an options trading venue, asset classes traded and published.

Cboe Global Markets (Cboe) is the leading exchange network for global derivatives, foreign exchange, digital asset and securities trading solutions. We've. Its subsidiary Cboe is the largest U.S. options exchange and the creator of listed options. Cboe Global Markets, Inc. offers equity, index and ETP options. a securities exchange for the trading of standardized options contracts, primarily stock, stock index, and interest rate options. Cboe Global Markets, Inc. engages in the provision of trading and investment solutions to investors. It operates through the following business segments. Cboe Global Markets completed its acquisition of NEO Exchange Inc. in Now operating as Cboe Canada, we NEO is a dynamic FinTech company that provides. Battea's CBOE Exchange & Futures VIX Manipulation Case Spotlight highlights the intention to create and promote the VIX, thus rigging of the marketplace. (An options trading facility of NYSE Arca, Inc.) South Wacker Drive Suite Chicago, IL Telephone: () Futures Markets. Cboe Futures. Cboe Exchange, Inc. (CBOE) · Notice of Withdrawal of Proposed Rule Change to Permit Cboe to List and Trade Options on ETPs That Hold Bitcoin · Notice of Filing of. Products ; cboe_all, CBOE (Chicago Board Options Exchange). Last updated August 1st, Data updated monthly. ; cboe_eod, CBOE Options End of Day. Last updated. Get Cboe Global Markets Inc (CBOE:CBOE) real-time stock Profile. MORE. Cboe Global Markets, Inc. is a provider of derivatives and securities exchange. Cost-efficient, low-latency solution to access major market centers. Trade Alert. Options order-flow and volatility analysis with real-time context and insight. Cboe Digital futures are offered through Cboe Digital Exchange, LLC, a Commodity Futures Trading Commission (CFTC) registered Designated Contract Market (DCM). S&P DJI combines global reach with local expertise, working with exchanges around the world to build indices for both the local and international investment. The CBOE Options Exchange serves as a trading platform, similar to the New York Stock Exchange or Nasdaq. It has a history of creating its own tradable products. Launched in as the NEO Exchange, and acquired by Cboe Global Markets in , Cboe Canada is the third most active marketplace in Canada, consistently. TT® provides access to the Chicago Board Options Exchange (CBOE), which is an open access market that is home to listed options contract, index options, and VIX. TT® provides access to the Chicago Board Options Exchange (Cboe) SPOT FX, which is an OTC market that offers trading FX spot instruments. Cboe completed its. Cboe Global Markets, Inc., through its subsidiaries, operates as an options exchange worldwide. It operates through six segments: Options, North American. Cboe Global Markets, Chicago, Illinois. likes · 75 talking about this · were here. The exchange for the world stage. Connecting people to. From equities and derivatives to foreign exchange and digital assets, we build trusted, inclusive global marketplaces. For more on how to leverage our global.

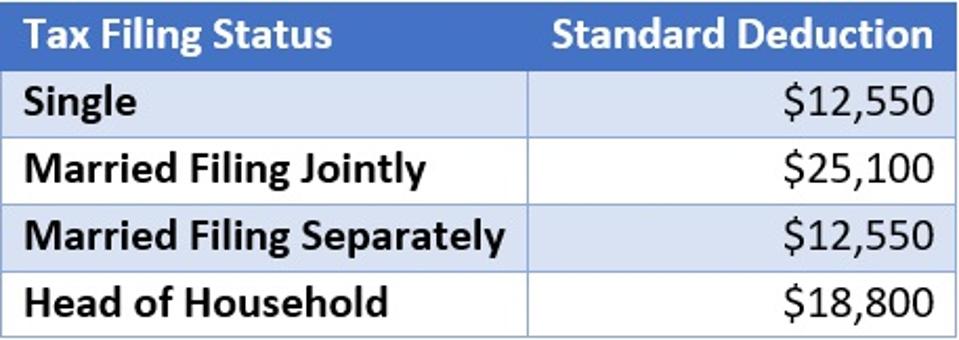

Federal Income Tax Brackets 2021 Married Filing Jointly

But substantial rises in the U.S. inflation rate in and of taxable income for married couples filing jointly, the first $10, of taxable income for. For married couples filing jointly, the range is $, to $, Income within this bracket is taxed at a 24% rate. 32% Bracket: The 32% bracket is for. Married Individuals Filing Joint Returns, & Surviving Spouses ; Not over $19, 10% of taxable income ; Over $19, but not over $81, $1, plus 12% of. What are the federal income tax brackets? ; If taxable income is over: but not over: the tax is: ; $0, $11,, 10% of the amount over $0 ; $11,, $47, Federal Income Tax Rates ; $23, - $94,, $11, - $47,, $16, - $63,, $11, - $47, ; $94, - $,, $47, - $,, $63, - $, If the result is zero or less, enter “0.” Utah has a single tax rate for all income levels, as follows: Date Range, Tax Rate. January 1, Below are the tax rate schedules for Individual Tax Rate Schedules for Marginal Tax Bracket Rate, Single Taxable Income, Married Filing Jointly. federal income tax two people might pay if they were to marry. It compares the taxes a married couple would pay filing a joint Results for tax year The tax rates themselves are the same as the rates in effect for the tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. But substantial rises in the U.S. inflation rate in and of taxable income for married couples filing jointly, the first $10, of taxable income for. For married couples filing jointly, the range is $, to $, Income within this bracket is taxed at a 24% rate. 32% Bracket: The 32% bracket is for. Married Individuals Filing Joint Returns, & Surviving Spouses ; Not over $19, 10% of taxable income ; Over $19, but not over $81, $1, plus 12% of. What are the federal income tax brackets? ; If taxable income is over: but not over: the tax is: ; $0, $11,, 10% of the amount over $0 ; $11,, $47, Federal Income Tax Rates ; $23, - $94,, $11, - $47,, $16, - $63,, $11, - $47, ; $94, - $,, $47, - $,, $63, - $, If the result is zero or less, enter “0.” Utah has a single tax rate for all income levels, as follows: Date Range, Tax Rate. January 1, Below are the tax rate schedules for Individual Tax Rate Schedules for Marginal Tax Bracket Rate, Single Taxable Income, Married Filing Jointly. federal income tax two people might pay if they were to marry. It compares the taxes a married couple would pay filing a joint Results for tax year The tax rates themselves are the same as the rates in effect for the tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Depending on your income and filing status, there are 7 IRS tax brackets for the Tax Year: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Tax brackets (Taxes due in ) ; Tax Rate, Single Filers/ Married Filing Separate (MFS), Married Individuals Filing Jointly/ Qualifying Surviving Spouses. file a federal income tax return must file a Louisiana Individual Income Tax Return. percent. Married filing jointly or qualified surviving spouse: First. Wouldn't the capital gain be 0%? Long-term capital gains for married filing jointly are zero for , in income. Or at least that's what I've read. Personal income tax rates ; Single taxpayers (1) · 0 to 11, · 11, to 44, ; Married taxpayers filing jointly (1, 2) · 0 to 22, · 22, to 89, ; Head-of-. Income Tax Brackets · $, for married individuals filing jointly and surviving spouses, · $, for single individuals and heads of households. Seven tax brackets exist for the tax year or taxes due in April or October , with an extension. These are 10pc, 12pc, 22pc, 24pc, 32pc, 35pc and. Calculate your annual federal and provincial combined tax rate with our easy online tool. EY's tax calculators and rate tables help simplify the tax process for. Federal Taxes ; 32%. $, $, ; 35%. $, $, ; 37%, $,, $, ; Source: Internal Revenue Service. Tax Brackets for , , and Back Taxes in Previous Tax Years. Get to Know How You Are Being Taxed by Income; Find Your Effective Tax Rate. Tax Brackets ; Tax Rate, Single Filers, Married Filing Jointly ; 10%, up to $9,, up to $19, ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to. What are the federal income tax brackets? ; If taxable income is over: but not over: the tax is: ; $0, $11,, 10% of the amount over $0 ; $11,, $47, Federal Income Tax Rates ; $23, - $94,, $11, - $47,, $16, - $63,, $11, - $47, ; $94, - $,, $47, - $,, $63, - $, Under the new law, taxpayers must use the same filing status used on the federal tax return. These filing statuses include married filing jointly, qualifying. Example: VT Taxable Income is $82, (Form IN, Line 7). Filing Status is Married Filing Jointly. Use Schedule Y Base Tax is. $2, for married individuals filing a joint return for marginal income tax rates for married filing jointly tax payers at stated income levels. marginal Income Tax rate to % for Tax Year Taxpayers who are taxed Both spouses must sign a married filing joint return. DO, Send all 3. Example: VT Taxable Income is $82, (Form IN, Line 7). Filing Status is Married Filing Jointly. Use Schedule Y Base Tax is. $2, Tax bracket ranges also differ depending on your filing status. For example, for the tax year, the 22% tax bracket range for single filers is $47, to. The federal income tax bracket determines a taxpayer's tax rate. There are seven tax rates for the tax season: 10%, 12%, 22%, 24%, 32%, 35% and 37%.