kamerin.ru

Market

What To Do If You Lost An Old W2

You'll need to fill out form T to get a transcript of your earning information. This is your best option when you only need part of the information. If you do not receive the missing form in sufficient time to file your tax return timely, you may use the Form (PDF). If you receive the missing or. Use the “IRS Order a Transcript” application to view and print your tax transcript(s) immediately. You may also call the IRS self-service line at I cannot locate my W-2s. Can I provide a copy of my Federal Income Tax Return? Contact your employer to attempt to obtain your W · If you still haven't received it by February 14, contact the IRS at and provide as much. Electronic copies of W-2s are available in HIP for calendar year onward. To obtain a copy of an older W-2, employees must request a copy from their payroll. You can contact an IRS agent by calling in at or schedule an appointment through the IRS Taxpayer Assistance Center. To plan ahead for your phone. Form W-2, Wage and Tax Statement, is prepared by your employer. If you did not receive your W-2, contact your employer. Employers are required to issue W Tell your employer if they don't send it to you then you will call the IRS who will then contact them and compel them to send you a new W You'll need to fill out form T to get a transcript of your earning information. This is your best option when you only need part of the information. If you do not receive the missing form in sufficient time to file your tax return timely, you may use the Form (PDF). If you receive the missing or. Use the “IRS Order a Transcript” application to view and print your tax transcript(s) immediately. You may also call the IRS self-service line at I cannot locate my W-2s. Can I provide a copy of my Federal Income Tax Return? Contact your employer to attempt to obtain your W · If you still haven't received it by February 14, contact the IRS at and provide as much. Electronic copies of W-2s are available in HIP for calendar year onward. To obtain a copy of an older W-2, employees must request a copy from their payroll. You can contact an IRS agent by calling in at or schedule an appointment through the IRS Taxpayer Assistance Center. To plan ahead for your phone. Form W-2, Wage and Tax Statement, is prepared by your employer. If you did not receive your W-2, contact your employer. Employers are required to issue W Tell your employer if they don't send it to you then you will call the IRS who will then contact them and compel them to send you a new W

The IRS will send a letter to your employer requesting that they furnish the missing W-2 within ten days. This tactic often works because most employers take. That's why you will need to turn to your company's HR or accounting department. Old W2 forms can be requested in other ways, as well. What to Do If You Lost. Like asking for your pay stubs, you can get your W-2 by calling or sending an e-mail to your payroll administrator. Check if they have your mailing address. Additionally, you can request to pick-up your reprint in person. [You will be notified once the reprint is ready for pick-up.] If you are unable to submit your. Contact the employer who issued your W-2 and request a replacement. It may take them a couple of weeks, so make a note and post it where it won'. You can request an IRS transcript of your tax return from the IRS website. A transcript includes items from your tax return as it was originally filed and will. How do I obtain a copy of my W2? · Log in to using your user ID and password. · Scroll to the Individual Income Tax portion of the page and select “Submit a. Whether you owe additional taxes or are due a tax refund, you should always file your tax return on time even if you have incomplete information due to missing. For Home Healthcare Providers duplicate W-2 requests, please call the Department of Health and Human Services (DHHS) at Filing taxes after you've separated. If you've separated within 13 months, you can login to your myPay account to get your W2. If you can't access your. If you cannot obtain your W-2 from your employer or their payroll provider, you can order a copy from the IRS by using the IRS's “Get Transcript” tool, form. You also can request one from the State Controller's Office. To do so you must obtain a Standard Form Request for Duplicate Wage and Tax Statement: As a. If you use a Form to request a previous year's tax return, you will only get a copy of your actual W-2 if you filed your taxes on paper that year (as. The IRS will also send you Form , which you can use if you do not receive the missing form in time to file your taxes. When filling out your Form you. If you do not receive the missing information in time to file, you may use Form , Substitute for Form W-2, Wage and Tax Statement. Attach Form to the. If your W-2 Form is not legible or if you have lost it, contact your employer and request another. If you still do not receive your W-2 Form, you will need to. Make the process of distributing annual tax forms more efficient by providing employees online, self-service access. If you decide only to provide the forms. Also, form W-2s for years – are available on CIS. If you are a current employee that opted for a printed W-2, and didn't receive or lost your printed. Requests for copies of your W-2(s) must be made to your employer. If your employer is unable to provide a copy, you will need to request a substitute income. Your employer is required to issue a wage and tax statement, Form W-2, by January 31st if you earned wages during the previous calendar year. If you haven't.

Stock Market Expectations For Today

Latest Stock market outlook, share Market Outlook, market news, special reports, photos, videos and more on Moneycontrol. Market Update audiocast series. 1MarketWatch, “Stock market today: Dow down points as recession fears bulldoze stocks,” August 2, July 12, Read our weekly market review, complete with commentary on the previous week in the stock markets and our outlook for the upcoming week. Saying that, we do not expect meaningful follow-through to the upside from current levels over the balance of this year. Uncertainty over the underlying. expectations for Federal Reserve policy have changed markedly. Sadly, I am old enough to remember the day in October when global equity markets crashed. stock prices. Instead, short-term price changes are driven by the news of the day and the direction of corporate earnings— which, by the way, is currently up. Where the stock market will trade today based on Dow Jones Industrial Average, S&P and Nasdaq futures and implied open premarket values. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. Get a jump start on all major news before the markets open with our daily Ahead of Wall Street article. Latest Stock market outlook, share Market Outlook, market news, special reports, photos, videos and more on Moneycontrol. Market Update audiocast series. 1MarketWatch, “Stock market today: Dow down points as recession fears bulldoze stocks,” August 2, July 12, Read our weekly market review, complete with commentary on the previous week in the stock markets and our outlook for the upcoming week. Saying that, we do not expect meaningful follow-through to the upside from current levels over the balance of this year. Uncertainty over the underlying. expectations for Federal Reserve policy have changed markedly. Sadly, I am old enough to remember the day in October when global equity markets crashed. stock prices. Instead, short-term price changes are driven by the news of the day and the direction of corporate earnings— which, by the way, is currently up. Where the stock market will trade today based on Dow Jones Industrial Average, S&P and Nasdaq futures and implied open premarket values. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. Get a jump start on all major news before the markets open with our daily Ahead of Wall Street article.

US Markets: Get the complete US Stock Markets coverage with latest news Today; Tomorrow; This Week; Next Week. No Events Scheduled. Show More. INVEST IN. Forecasts, projections and other forward-looking statements are based upon current beliefs and expectations. They are for illustrative purposes only and. Find the latest stock market news from every corner of the globe at Currenciescategory Sterling drops versus euro, focus on rate outlook AM UTC. Summary · Stats · Forecast · Alerts. Data is a real-time snapshot *Data is delayed at least 15 minutes. Global Business and Financial News, Stock Quotes, and Market Data and Analysis. Market Data. According to Deutsche Bank's stock market outlook, the US economy is approaching a soft landing as inflation cools and GDP growth remains solid, and that's. Find the latest stock market trends and activity today. Compare key indexes Gold Price Forecast: Triggers Weekly Breakdown. Jun 26, FX Empire. today's markets. At Morgan Stanley, we lead with exceptional ideas. Across “The market may have largely priced in expectations for growth tied to. Markets News, Jan. 17, Stocks Retreat as Central Banks Temper Rate Cut Expectations · Equity Indexes Wrap: Insurance, Food Rise as Investors Dump. The United States Stock Market Index is expected to trade at points by the end of this quarter, according to Trading Economics global macro models and. Stock Market Outlook · S&P Prepping For The Break-Out, Week Starting September 3rd (Technical Analysis) · September Monthly · The Market Could Be In For. Where the stock market will trade today based on Dow Jones Industrial Average, S&P and Nasdaq futures and implied open premarket values. The US equity market edges further into overvalued territory. Out of the more than stocks that we cover, the US equity market is trading at a premium to our. Stock market prediction is the act of trying to determine the future value of a company stock or other financial instrument traded on an exchange. Soft-landing expectations are likely to persist over the next few months as inflation concerns decline. The asymmetry in the mid-year return outlook, however. Today the · CNN. Fear Greed Index closed at a 50 day high. Closing at above the high set on 7/ I shared a backtest a while back that had some. EM-DM relative GDP growth acceleration: Today, economic The preceding outlook reflects the views and analysis of Lazard's emerging markets equity team. “Be wary of the human tendency to fight the last war,” the famed investor Barton Biggs once warned. Most investors today are fighting the last war—the bear. Breaking news and in-depth coverage from the global business and financial markets. The latest corporate earnings reports from the stock market and insights.

Multi Touch Attribution Pardot

Multi-touch attribution is the act of determining the value of each customer touchpoint that leads to a conversion. Pardot® Multi-Touch Attribution Reporting inside Salesforce. Marry your Pardot and Salesforce data for easy to use, customizable multi-touch marketing and. Pardot's B2B Marketing Analytics multi-touch attribution product is still based on Salesforce Campaigns. So yes, you can Look at ROI from a First Touch, Last. Pardot Multi-Touch Attribution Reporting inside kamerin.ru Marry your data for a complete view of the buyer's journey and ROI insights. Multi-touch attribution (MTA) is the measurement that distributes credit of a sale to the multiple advertisements encountered by a customer before the. To distinguish Pardot from Marketing Cloud, Pardot primarily functions as an email marketing and nurture platform. touch attribution, an Account-Based. Pardot data connected with diverse tech stacks for B2B multi-touch attribution. Easy and simple integration of Pardot marketing automation with Dreamdata. Fill out the form below and a Salesforce + Account Engagement (Pardot) expert will contact you for a free walk-through. Multi-touch attribution is a marketing technique that assigns Marketing Automation Platform (Marketo, Hubspot, Eloqua, Pardot, etc.) CRM. Multi-touch attribution is the act of determining the value of each customer touchpoint that leads to a conversion. Pardot® Multi-Touch Attribution Reporting inside Salesforce. Marry your Pardot and Salesforce data for easy to use, customizable multi-touch marketing and. Pardot's B2B Marketing Analytics multi-touch attribution product is still based on Salesforce Campaigns. So yes, you can Look at ROI from a First Touch, Last. Pardot Multi-Touch Attribution Reporting inside kamerin.ru Marry your data for a complete view of the buyer's journey and ROI insights. Multi-touch attribution (MTA) is the measurement that distributes credit of a sale to the multiple advertisements encountered by a customer before the. To distinguish Pardot from Marketing Cloud, Pardot primarily functions as an email marketing and nurture platform. touch attribution, an Account-Based. Pardot data connected with diverse tech stacks for B2B multi-touch attribution. Easy and simple integration of Pardot marketing automation with Dreamdata. Fill out the form below and a Salesforce + Account Engagement (Pardot) expert will contact you for a free walk-through. Multi-touch attribution is a marketing technique that assigns Marketing Automation Platform (Marketo, Hubspot, Eloqua, Pardot, etc.) CRM.

As more SaaS companies are using multi-touch attribution to smarten up their sales and marketing efforts, they rely on tools and technology to get the job done. Marketing Cloud/Pardot · Salesforce · Plans · Resources · About Us · Reach Us · Latest SLX Auto Attribution ™, simplifies and supercharges Multi-touch. Grow your marketshare with multi touch attribution powered by machine learning. Drive conversions with high value opportunities verified by data. €/month. A simple way to get started with multi-touch attribution and boost marketing. Journeys / month. Features. Dashboarding integrations. Get in. Pardot's Multi-touch attribution model allows marketers to visualise campaign ROI across the funnel to prioritize channels and programmes that work best. multi-touch attribution. Marketing attribution enables Marketers to identify which tactics contribute to key business outcomes, providing them with the. Pardot). You will learn about 5 different campaign attribution models Cons for Multi Touch Models: Not all campaigns influenced the opportunity in. How do you track multi-touch marketing attribution in Salesforce? These Pardot and Salesforce (AKA Marketing Cloud Account Engagement). Pardot/MCAE. When it comes to #attribution, you can always count on Greg Poirier to give an opinion (based on years of experience) even if it might. multi-touch attribution models from Pardot. If you want to discuss your requirements before enabling the feature, get in touch with us to find out how you. Marketing attribution modelling enables you to use Pardot to track ROI on the source where the prospect was acquired. However, we want to be able to see how. multi-touch, cross-channel, omni-channel attribution. The vendors listed Pardot – Pardot is the marketing automation solution offered by Salesforce. And while multi-channel strategies have become easier to implement and manage with cross-platform and integration tools, there is often ton of confusion as to. Discover how HubSpot's multi-touch attribution model can elevate your marketing strategy by accurately assigning credit to each touchpoint in the buyer. Marketing Automation Platform (Marketo, Hubspot, Eloqua, Pardot, etc.) CRM Unlike the existing Multi-Touch Attribution (MTA) method, Chain-Based. Multi-touch attribution is one of the hot marketing Pardot integrated multi-touch influence attribution to its platform, complete with. Pardot by Salesforce uses attribution models to help B2B marketers understand the multi-touch customer journey, connecting user engagement to revenue. Marketo's. Act-On stands apart among Pardot competitors. We do one thing: empower marketers to build business value by segmenting, personalizing, and optimizing their. Marry your Pardot and Salesforce data for easy to use, customizable multi-touch marketing and lead attribution reporting with AttributeApp. Built for B2B. Leverage HockeyStack's lift analysis and multi-touch attribution to measure the influence of your Pardot automation campaigns with more precision. Multi-touch.

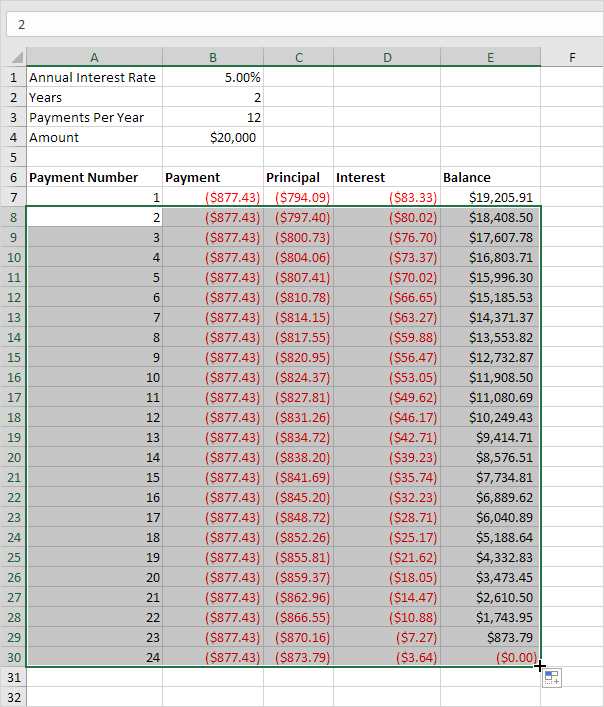

Amortization Payment Schedule

An amortization schedule is a data table that shows the progress of you paying off your mortgage loan. What is an amortization schedule? Amortization is the process of gradually repaying your loan by making regular monthly payments of principal and interest. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. The monthly payments you make are calculated with the assumption that you will be paying your loan off over a fixed period. A longer or shorter payment schedule. Loan Amortization Schedule Calculator ; $1, Monthly Principal & Interest ; $, Total of Payments ; $, Total Interest Paid ; Sep, payment, total of all payments made, and total interest paid. Press the report button to see a monthly payment schedule. Javascript is required for this. A amortization schedule is a table or chart showing each payment on an amortizing loan, including how much of each payment is interest and the amount going. Your monthly principal and interest is $, but it would take payments until more money is directed to principal than interest. The road to building. Use our amortization schedule calculator to estimate your monthly loan repayments, interest rate, and payoff date on a mortgage or other type of loan. An amortization schedule is a data table that shows the progress of you paying off your mortgage loan. What is an amortization schedule? Amortization is the process of gradually repaying your loan by making regular monthly payments of principal and interest. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. The monthly payments you make are calculated with the assumption that you will be paying your loan off over a fixed period. A longer or shorter payment schedule. Loan Amortization Schedule Calculator ; $1, Monthly Principal & Interest ; $, Total of Payments ; $, Total Interest Paid ; Sep, payment, total of all payments made, and total interest paid. Press the report button to see a monthly payment schedule. Javascript is required for this. A amortization schedule is a table or chart showing each payment on an amortizing loan, including how much of each payment is interest and the amount going. Your monthly principal and interest is $, but it would take payments until more money is directed to principal than interest. The road to building. Use our amortization schedule calculator to estimate your monthly loan repayments, interest rate, and payoff date on a mortgage or other type of loan.

An amortization schedule is the loan report showing the amount paid each period and the portion allocated to principal and interest. A schedule that breaks down how principal and interest are applied with each monthly payment throughout the life of a loan. amortization schedule for your loan with this online calculator You can then examine your principal balances by payment, total of all payments made, and total. This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments. An amortization schedule is used to reduce the current balance on a loan—for example, a mortgage or a car loan—through installment payments. This calculator will compute a loan's payment amount at various payment intervals — based on the principal amount borrowed, the length of the loan and the. An amortization schedule is a table that shows the amount of interest and principal you pay each month over time. In addition, the schedule will show you the. To calculate amortization, first multiply your principal balance by your interest rate. Next, divide that by 12 months to know your interest fee for your. A schedule that breaks down how principal and interest are applied with each monthly payment throughout the life of a loan. Accelerated bi-weekly payment options are calculated by taking a monthly payment schedule and assuming only four weeks in a month. We calculate an. An amortization schedule for a loan is a list of estimated monthly payments. At the top, you'll see the total of all payments. For each payment, you'll see the. Select Calculate, and you'll get an amortization schedule where you can see how much of each payment reduces the loan balance, and how much goes to interest. An amortization schedule is a table that provides both loan and payment details for a reducing term loan. · In general, amortization schedules are provided to. An amortization schedule is a table that displays each payment for your loan under a structured plan, detailing how each installment covers both interest and. Create an amortization schedule for fixed-principle declining-interest loan payments where the principal remains constant while the interest and total. This spreadsheet creates an amortization schedule for a fixed-rate loan, with optional extra payments. The payment frequency can be annual, semi-annual. Amortization schedules use columns and rows to illustrate payment requirements over the entire life of a loan. Looking at the table allows borrowers to see. Amortization Calculator ; Principal. Payments per Year ; Annual Interest Rate. Number of Regular Payments ; Balloon Payment. Payment Amount. An amortization schedule is a table detailing each periodic payment for amortizing a loan. Amortization is the process of paying off a debt over time through. Use this amortization calculator to estimate the principal and interest payments over the life of your mortgage. You can view a schedule of yearly or monthly.

When Should I Sell My Stock Options

Exercise your stock options to buy shares of your company stock, then sell just enough of the company shares (at the same time) to cover the stock option cost. A stock option is a contract between two parties that gives the buyer the right to buy or sell underlying stocks at a predetermined price and within a. When Should You Exercise or Sell Your Company Stock Options? · #1: Whether the company stock options have value · #2: Whether your company is private or public · #. In our example above, if the stock option could be exercised in full this sell the unvested shares back to the company. The company only uses those. It depends on your risk tolerance, how much (%) of your overall portfolio those options constitute, and more. According to IBD founder William O'Neil's rule in "How to Make Money in Stocks," you should sell a stock when you are down 7% or 8% from your purchase price. Stock options give you the right to buy or exercise a set number of shares of the company stock at a pre-set price. However, this offer doesn't last forever. The are 3 primary reasons when to exercise your employee stock options; Expiration is Imminent, Exercising Early, and Reducing Taxes. Exercise your stock options to buy shares of your company stock, then sell just enough of the company shares (at the same time) to cover the stock option cost. Exercise your stock options to buy shares of your company stock, then sell just enough of the company shares (at the same time) to cover the stock option cost. A stock option is a contract between two parties that gives the buyer the right to buy or sell underlying stocks at a predetermined price and within a. When Should You Exercise or Sell Your Company Stock Options? · #1: Whether the company stock options have value · #2: Whether your company is private or public · #. In our example above, if the stock option could be exercised in full this sell the unvested shares back to the company. The company only uses those. It depends on your risk tolerance, how much (%) of your overall portfolio those options constitute, and more. According to IBD founder William O'Neil's rule in "How to Make Money in Stocks," you should sell a stock when you are down 7% or 8% from your purchase price. Stock options give you the right to buy or exercise a set number of shares of the company stock at a pre-set price. However, this offer doesn't last forever. The are 3 primary reasons when to exercise your employee stock options; Expiration is Imminent, Exercising Early, and Reducing Taxes. Exercise your stock options to buy shares of your company stock, then sell just enough of the company shares (at the same time) to cover the stock option cost.

Should I exercise my options before I quit, and how long do I have after I do? It's ideal to exercise your options while you're still part of the company, but. The holder of an American-style option can exercise their right to buy (in the case of a call) or to sell (in the case of a put) the underlying shares of. Exercise your option to purchase the shares and sell them after 12 months or less, but during the following calendar year. Sell shares at least one year and a. Some key factors to consider when exercising your options include when to exercise them, how to exercise them and the tax implications of your choices. A generous stock option benefit is certainly nothing to complain about. But it does have a significant risk—the possibility that too much of your wealth will be. If you're crossing that threshold, you might think about selling enough stock each year to keep your nest egg safe from excess volatility risk. To account for. How are my options taxed? (Note: UBS Financial Services Inc. does not give tax advice. The following information is intended to help you. The best option to diversify is to immediately sell the company stock and reallocate it across your portfolio. Since this can be psychologically difficult, you. At this stage, founders and employees can all be given stock (instead of options). But as a company evolves, the shares grow in value. If an investment is made. Stock Option Exercises; Sale of Option Shares. You may exercise vested Before engaging in any transaction in the Company's stock, the Insider should. You can only sell stock, or stock options, back to a privately held company if the company agrees to buy them (or has a contract requiring. Finally, if you exercise your options and the price decreases, then you lose both the money you've used to exercise the shares as well as any associated taxes. If your company goes public and you haven't previously exercised your options, it might make sense to do a same-day sale (exercise your options and immediately. Unlike some video games, in options trading, it's not always a good thing to be the last person standing. As you get closer to 3 p.m. CT on expiration day. When a company grants you employee stock options, they are giving you the right to buy company stock at a specified price (known as a "strike price"), within a. However, if the stock price rebounds, the option could return to in the Do Not Sell or Share My Personal Information. This is for persons in the US. While options carry significant upside leverage, remember that they are a use-it-or-lose-it proposition. If your options expire below the exercise price during. You should receive the proceeds of your sale in the form of a check four Who do I call if I have questions about my employee stock options? A. Call. could do with their options. Here are six things employees at stock in privately held companies is typically not liquid and is difficult to sell. One of the first things that I look for is volatility in how the stock has been trading. When you sell options, you want to have that volatility because it.

Best Rated Outdoor Trampolines

/GettyImages-901093436-5c251fefc9e77c00010cd137.jpg)

Maybe look at SkyBound, Skywalker, and Acon. Acon is suggested by people I trust, as a mid-high quality brand. They make some good trampolines. Sky Zone Indoor Trampoline Parks are an exciting entertainment, fitness, and sports experience for the whole family. Visit your nearest park today to learn. Skywalker Trampolines are regarded as one of the best trampoline brands, and for good reason: they're known for making high quality trampolines that last! This. Akrobat in-ground and above ground trampolines are a great way to get exercise, share family time, and have fun outdoors in your own backyard! Winners · 1. Merax 14FT Trampoline – Editor's Choice · 2. Skywalker Trampolines Foot Jump N' Dunk – Trampoline With Best Safety Features · 3. Albott- Best. Top Rated Trampolines ; 16FT Trampoline for Kids with Upgraded Arc Pole and Composite TopLoop - Black. $ Comparison Price $ Edit: Zupapa have good ratings and come in below that figure -- but not by a lot. Factor in shipping if you don't have a local distributor. Trampolines ; Best PriceSave $ Zupapa Saffun Outdoor Trampoline With Enclosure · Zupapa Saffun Outdoor Trampoline With Enclosure ; New. Zupapa LBS. SKYWALKER TRAMPOLINES Jump N' Dunk 8 FT, 12 FT, 15 FT, Round Outdoor Trampoline for Kids with Enclosure Net, Basketball Hoop, ASTM Approval, LBS Weight. Maybe look at SkyBound, Skywalker, and Acon. Acon is suggested by people I trust, as a mid-high quality brand. They make some good trampolines. Sky Zone Indoor Trampoline Parks are an exciting entertainment, fitness, and sports experience for the whole family. Visit your nearest park today to learn. Skywalker Trampolines are regarded as one of the best trampoline brands, and for good reason: they're known for making high quality trampolines that last! This. Akrobat in-ground and above ground trampolines are a great way to get exercise, share family time, and have fun outdoors in your own backyard! Winners · 1. Merax 14FT Trampoline – Editor's Choice · 2. Skywalker Trampolines Foot Jump N' Dunk – Trampoline With Best Safety Features · 3. Albott- Best. Top Rated Trampolines ; 16FT Trampoline for Kids with Upgraded Arc Pole and Composite TopLoop - Black. $ Comparison Price $ Edit: Zupapa have good ratings and come in below that figure -- but not by a lot. Factor in shipping if you don't have a local distributor. Trampolines ; Best PriceSave $ Zupapa Saffun Outdoor Trampoline With Enclosure · Zupapa Saffun Outdoor Trampoline With Enclosure ; New. Zupapa LBS. SKYWALKER TRAMPOLINES Jump N' Dunk 8 FT, 12 FT, 15 FT, Round Outdoor Trampoline for Kids with Enclosure Net, Basketball Hoop, ASTM Approval, LBS Weight.

Coming in a variety of sizes, the Zupapa trampoline is among the most popular for a reason. It has a great balance of quality and price, remaining affordable. For quick summary Skywalker Trampolines (starts from $), Zupapa 15 FT Trampoline (starts at $), and ORCC Trampoline 15 FT Outdoor. Top Deals · Home · Outdoor · Outdoor Play · Trampolines. Trampolines. Show 1 Review · 3-in-1 Trampoline for Kids with Enclosure, Swing. Sportspower Bounce Pro 14' Trampoline with Heavy Duty Basketball System · Skywalker Trampolines 16' Deluxe Round Sports Arena Trampoline with Enclosure. Some of the most reviewed products in Outdoor Trampolines are the Trujump 12 ft. Trampoline with 6-Pole Enclosure in Blue with 12 reviews, and the Skywalker. Aww the trusty veterans and the original offering of Skywalker Trampolines between the $ to $ price range. This covers your basic trampoline play needs. Inside net or outside net? When seeking a trampoline there are two net styles to consider. A net that sits inside the padding area right at the edge of the. Springfree Trampoline, with its industry-leading safety and quality features, ranks at the top as the best trampoline for kids. However, there are multiple. Outdoor Trampoline Accessories · Nets: Nets and enclosures help prevent falls and keep everyone having fun. · Ladders: With ladders, it's easier. The Summer Sale is Finally Here! Save Up To $! Shop the Best Savings of the Year for Outdoor Trampoline at jumpfly. A Wonderful Gift for Your Family. We've found that the best trampolines for your budget are ones that last. JumpSport backyard trampolines come with over 50 patented safety and performance. Recommendations for backyard trampoline? –. Jan 11, (3 replies). We are trampoline as the best brand in our price range. Then I looked for deals. Need the perfect kids trampoline? Well, you came to the right place. Shop quality mini trampolines and outdoor trampolines built to last. Backyard Trampolines · Maocao Hoom. 14FT Round Outdoor Backyard Trampoline with Safety Enclosure Net, Zipper Door and Durable Mat - Blue · Propel Trampolines. The best trampolines for adults are those purpose-built to deliver smooth, consistent bounces no matter the size of the adult. Acon trampolines have no single-. Best Trampolines With Reviews · Inground 12' Round Trampoline with Safety Enclosure · Machrus Upper Bounce 7' Indoor/Outdoor Classic Kiddy Trampoline & Safety. Skywalker, Springfree Trampoline and Propel Trampolines are among the most popular Trampoline brands. While those brands are the most popular overall, you will. Top Rated · Skywalker SAL Trampolines Wide-Step Ladder Accessory Kit - Blue · Skywalker 15 Feet Square Trampoline with Enclosure - Blue · Skywalker Trampolines. Best Trampolines ; Upper Bounce Rectangle 10x17 Ft. Trampoline with Enclosure Set · Upper Bounce Rectangle 10x17 Ft. Trampoline with Enclosure Set. $ TRAMPOLINE. Sort by: Featured, Best selling, Alphabetically, A-Z, Alphabetically Mckinzee Adams from United States has rated a product. My kids love it.

Max Allowed To Contribute To 401k

In , self-employed individuals can contribute up to $ to a solo (k) (or up to $ if at least age 50) plus up to 25% of compensation as an. For , the annual maximum IRA contribution is $7,—including a $1, catch-up contribution—if you're 50 or older. For , that limit goes up by $ for. Contribution limits for (k) plans. , Employee pre-tax and Roth contributions1, $22,, $23, Maximum annual contributions2, $66,, $69, Your contribution (or “deferral”) limit depends, in part, on your age by year-end. If you turn 50 years old by the end of the year, the IRS allows you to make a. How Contributions Work With Limits · Salary deferral: $23,, plus · Employer matching $3, · Catch-up: $7, (k) contribution limits are limits placed by the US Congress on the amount of money that employees can contribute toward their retirement plan. The total contribution limit for (a) defined contribution plans under section (c)(1)(A) increased from $66, to $69, for This includes both. In the United States, a (k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection (k) of. Employees can invest more money into (k) plans in , with contribution limits increasing from $ in to $ in In , self-employed individuals can contribute up to $ to a solo (k) (or up to $ if at least age 50) plus up to 25% of compensation as an. For , the annual maximum IRA contribution is $7,—including a $1, catch-up contribution—if you're 50 or older. For , that limit goes up by $ for. Contribution limits for (k) plans. , Employee pre-tax and Roth contributions1, $22,, $23, Maximum annual contributions2, $66,, $69, Your contribution (or “deferral”) limit depends, in part, on your age by year-end. If you turn 50 years old by the end of the year, the IRS allows you to make a. How Contributions Work With Limits · Salary deferral: $23,, plus · Employer matching $3, · Catch-up: $7, (k) contribution limits are limits placed by the US Congress on the amount of money that employees can contribute toward their retirement plan. The total contribution limit for (a) defined contribution plans under section (c)(1)(A) increased from $66, to $69, for This includes both. In the United States, a (k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection (k) of. Employees can invest more money into (k) plans in , with contribution limits increasing from $ in to $ in

Your contribution (or “deferral”) limit depends, in part, on your age by year-end. If you turn 50 years old by the end of the year, the IRS allows you to make a. Roth (k) contribution limits. The maximum amount you can contribute to a Roth (k) for is $23, if you're younger than age This is an extra. For , the annual maximum IRA contribution is $7,—including a $1, catch-up contribution—if you're 50 or older. For , that limit goes up by $ for. Contributions ; Account type. contribution limit. contribution limit ; Traditional IRA. $6, ($7, if you are age 50 or older).*. $7, in ($. For the tax year , the maximum amount that an employee can contribute to their (k) retirement plan is $23, That is $ more than you were allowed to. In , the basic contribution limit was $19,; however, for , the IRS raised this limit by $1,, making it $20, Also, this limit is for your total. The dollar limit can consist of all before-tax, all Roth (after-tax) or a combination of the two. If a participant is contributing to another (k) or a (b). According to the IRS, you can contribute up to $20, to your (k) for By comparison, the contribution limit for was $19, This number only. Under age 50, $23, ; Maximum employer and employee contributions, $69, ; pre-tax contribution limit · Dual qualified, $20, For , the contribution limits are as follows: You can put up to $6, into an IRA, or $7, if you're 50 or older. For a (k) or (b), you can. The annual deferral limit across all your retirement plans is $ for Employer match does not count towards the (k) limit, however, the IRS does limit the combined contribution from the employer and the employee. If you choose to make nonelective contributions, the employer contribution goes to each eligible participant, whether or not the participant decides to. Limit on after tax contributions: 10% of participant's maximum recognizable compensation for all years of participation in the retirement plan. * Age 50 and. The normal contribution limit for elective deferrals to a deferred compensation plan is increased to $22, in Employees age 50 or older may. Roth (k) contribution limits. The maximum amount you can contribute to a Roth (k) for is $23, if you're younger than age This is. The contribution limit for employees who participate in (k), (b), most plans, and the federal government's Thrift Savings Plan is increased to. Contributions ; Account type. contribution limit. contribution limit ; Traditional IRA. $6, ($7, if you are age 50 or older).*. $7, in ($. For , the annual maximum IRA contribution is $7,—including a $1, catch-up contribution—if you're 50 or older. For , that limit goes up by $ for. k contribution limits are set by the IRS to state how much an individual and employer are allowed to put into a k account. These limits may be.